Technical intro to DeFi lending protocols with zkLend codebase as an example

October 26, 2023

⏳ 40 min read

Here’s an extensive intro to DeFi lending protocols, especially for a dummy like me. We will look at fundamental concepts and theory, primarily complemented by zklend smart contract codebase at the commit hash of 10dfb3d1f01b1177744b038f8417a5a9c3e94185.

How a lending protocol works

Functionalities

There are 4 major functionalities that a lending protocol provides to the users:

Deposit

Users can deposit tokens into the smart contract as much as they want. For example, I can deposit 1000 USDC into the smart contract.

This will accrue interest over time. The interest accrual can only happen when there is at least one borrower, because the borrower will need to pay for the depositor’s interests. Otherwise, the interest rate stays at 0%. Deposit is the beginning of every other functionalities.

Borrow

Users are able to borrow certain amount of token, but only based on the amount of collaterals by depositing. For example, you may supply 1.1 ETH to borrow 500 USDC, only if 1.1 ETH is sufficiently more than the value of 500 USDC in USD.

For example, 1.1 ETH is 1,813.79 USD today, and 500 USDC is approximately 500 USD. The collateralization factor, which denotes the value of borrowed amount that can be covered with an amount of collateralized token, is 80%. This means USD worth of other assets can be borrowed from the protocol. This way, all of the borrowings in the protocol are backed by overly sufficient amount of tokens, which is called overcollateralization.

But why borrow in the first place, if you already have as much as (or even more than) the amount of token that you want to borrow?

Below are the possible reasons:

Leverage

Here’s a table describing the variables for this example:

| name | value |

|---|---|

| Price of 1 ETH in USD | 1200 |

| Price of 1 USDC in USD | 1 |

| Bob’s initial ETH balance | 2 |

| Collateral factor of ETH | 80% |

| Gas fees, interests | 0 |

Bob thinks the value of ETH will dramatically increase over time, so just a simple x1 long position is not enough for him. He is so sure that he want to get more than x1 profit when the price of ETH increases. This is how he would position himself at a leveraged long position:

- Bob deposits 2 ETH into the protocol

- Bob borrows worth of USDC from the protocol. Now he can spend 1200 USDC for whatever he wants.

- Bob goes to Uniswap, and swaps 1200 USDC for 1 ETH.

- Now Bob owns 3 ETH, although he has a debt of 1200 USDC.

- A few days later, the price of 1 ETH in USD increases to 1600 USD. Now his total profit off of this increase is :

- Bob now swaps his 1 ETH with 1600 USDC. Then he repays for his 1200 USDC debt. He still has 400 USDC left in his wallet.

- Then Bob withdraws 2 ETH from the protocol, and swaps that for USDC at Uniswap.

- USDC is the total he now has.

- Bob started with 2 ETH that was equivalent to 2400 USD, but after the price increase, he made additional 400 USD in addition to 800 USD that is the increase in the USD value of 2 ETH.

- Imagine if Bob held 3 ETH from the beginning. Then this would be valued at 4800 USD after the price increase, leaving Bob with 1200 USD of profit as well. Without the protocol, he wouldn’t have been able to achieve the same profit.

Other usages

Other use cases include shorting, liquidity management, arbitraging, etc. The list is not exhausitive and readily available on the Internet.

Liquidate

The value of tokens supplied as collaterals fluctuates over time. For example, if you have deposited 1.1 ETH as a collateral, it might be 1790 USD today, but it could have been 1809.47 USD yesterday. In such a case, the total value of collaterals might not be able to cover the total amount of tokens borrowed by a user.

Then other users get a chance to liquidate that user’s position. In liquidation, a substantial amount of the user’s debt can be repaid by the liquidator, and the borrower will take an additional percentage of the user’s collateral as a liquidation bonus (or a penalty, from POV of the borrower). More on this later too.

Repay

Repay for the amount of token you borrowed, plus the accrued interest.

Over-collateralization

Any lending protocol would want to assume over-colleteralization for maximum measure of security. Typically, the more volatile/unstable the price of an asset is, the lower collateral factor it would count for.

Usually, lending protocols would restrict which assets can be used as a collateral. However, it’s also worth noting that there are some protocols that allow users to create their own pairs of asset to be borrowed and collateralized.

An example of overcollateralization can be seen in any lending protocols; For example, $LINK has a 79% of collateral factor on Compound today. This means if you deposit $100 worth of $LINK, you will be able to borrow $79 worth of any assets without being liquidated.

Utilization rate

We will need to define a few key terms to further understand other concepts.

Utilization rate denotes how much of a single asset deposited in the pool is being borrowed at a time.

The utilisation rate of each pool is a function of the current outstanding loan amount over the total capital supply in the specific liquidity pool (from zklend whitepaper)

Here’s an example:

- Bob deposits 100 USDT (worth 100 USD) in USDT pool

- Alice deposits 100 DAI (worth 100 USD) in DAI pool

- The collateral factor of DAI is 80%, so Alice borrows 80 USDT, which is the maximum of what she can safely borrow without getting liquidated

- Now, the utilization rate of USDT is and that of DAI is

Utilization rate of an asset will change whenever there is a new borrowing or supply.

Here’s calculate_utilization_rate from zklend contract:

fn calculate_utilization_rate(reserve_balance: felt252, total_debt: felt252) -> felt252 {

if total_debt == 0 {

0

} else {

let total_liquidity = safe_math::add(reserve_balance, total_debt);

let utilization_rate = safe_decimal_math::div(total_debt, total_liquidity);

utilization_rate

}

}The function’s calculation is as follows: . Here, denotes the cash available in the liquidity pool that is not being utilized.

Note that when in used in practice, total_debt will have to reflect not only the principal that was borrowed by the user, but also the interests accrued. Otherwise the calculation will result in a wrong value that does not take any interests accrued into account.

Interest rate

For the interest rate, we need to talk about the interest rate model first. An interest rate model is meant to encourage borrowing when there is enough capital, and discourage borrowing (encourage repayment) and additional supply when there is not enough capital. Logically, we arrive at the conclusion that the interest rate must be high when there is high utilization rate, and low when there is low utilization rate.

We would also want to set an optimal utilization rate, because we generally would not want the utilization rate to be too low (no one’s using it) or too high (no one can borrow anymore).

It would be worth noting that the interest rates will change when every single transaction that affects the balance of supply or debt happens. The scope of the interest rates to be discussed in this post, therefore, are only variable interest rates.

Borrow interest rate

With all of these in mind, we can introduce this interest rate model for borrowing:

| Variable | Meaning | Domain (or Range) |

|---|---|---|

| Utilization rate | ||

| Optimal utilization rate | ||

| Interest rate at utiliation rate | ||

| Variable Rate Slope 1 (the slope that is going to be applied on the left side of the graph) | ||

| Variable Rate Slope 2 (the slope that is going to be applied on the right side of the graph) | ||

| Base interest rate. This adjusts the y-intercept of the interest rate curve. |

It may just be easy to use a graph to find out what it means rather than looking at the equations.

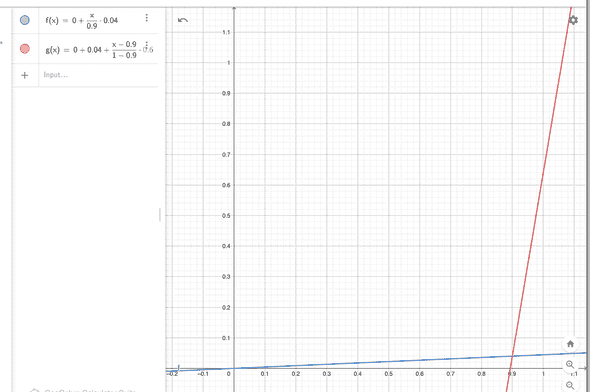

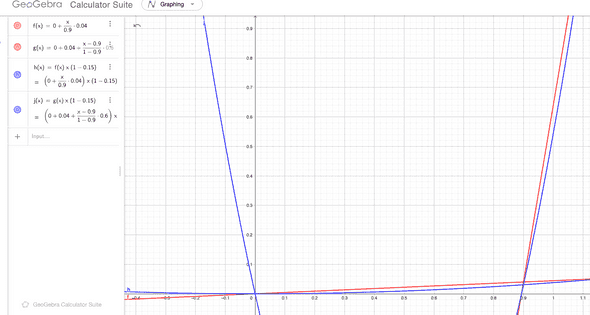

You can interact with the graphs I created here.

Below graph is the interest rate model for ‘Rate Strategy Stable One’ on Aave. This refers to “Low liquidity stablecoins have lower Optimal Utilisation Ratio than those with higher liquidity”. A rate strategy is just a list of variables used for the interest rate model. You would want to use different strategies for different crypto assets, owing to their stability/volatility. Every lending protocol has their own interest rate strategy for different assets; Zklend has also has one.

As you can see, until the utilization rate hits 90%, the interest rate stays quite low. But when it becomes slightly above 90%, the borrow interest rate would become 10%. This will (hopefully) act as an disincentive for people to borrow and incentive for the borrowers to repay the money, thereby decreasing the utilization rate, hopefully back to .

The calculation of borrow interest rate is handled by calculate_borrow_rate:

fn calculate_borrow_rate(self: @ContractState, utilization_rate: felt252) -> felt252 {

let params = self.curve_params.read();

let below_optimal_rate = Into::<_,

u256>::into(utilization_rate) <= Into::<_, u256>::into(params.optimal_rate);

if below_optimal_rate {

let temp_1 = safe_decimal_math::div(utilization_rate, params.optimal_rate);

let temp_2 = safe_decimal_math::mul(params.slope_0, temp_1);

let borrow_rate = safe_math::add(params.y_intercept, temp_2);

borrow_rate

} else {

// No need to use safe math here

let excess_utilization_rate = utilization_rate - params.optimal_rate;

let optimal_to_one = safe_decimal_math::SCALE - params.optimal_rate;

let temp_1 = safe_decimal_math::div(excess_utilization_rate, optimal_to_one);

let temp_2 = safe_decimal_math::mul(params.slope_1, temp_1);

let temp_3 = safe_math::add(params.y_intercept, params.slope_0);

let borrow_rate = safe_math::add(temp_2, temp_3);

borrow_rate

}

}curve_params has a type of CurveParams:

struct CurveParams {

slope_0: felt252,

slope_1: felt252,

y_intercept: felt252,

optimal_rate: felt252

}It does nothing but to define the variables we just saw in the equation of the borrow interest rate.

The function is pretty straightforward; if below_optimal_rate calculates the borrow interest rate when . else block calculates when .

Supply interest rate

The supply interest rate is the rate at which interest is generated when someone deposits a token into the liquidity pool. It must always be smaller than the borrow interest rate, because otherwise the protocol wouldn’t have a way to fund the interests and take some part of the borrow interests into its reserve.

is what we already calculated from the previous section. is the percentage of the borrowing interest rate that the protocol takes as a profit.

Let’s say we have a reserve factor of . If we take all rates into the axis, we will get:

The blue curve is the supply interest rate, and the red borrow interest rate. And we only care about the range of functions for which , where is the utilization rate.

As you noticed from the equation, the supply interest rate curve must always be a parabola, because we have being multipled by itself once ( has in it, and it’s being multiplied by again).

Compound interest calculation

Cumulated liquidity index

But calculating borrow and supply interest rates is not the end of the story. What we’ve looked at so far is calculation of simple interest rate, without regards to time.

If you have deposited a sum of a token, the interest should pile up on top of another as time goes on. Therefore we need a way to calculate compound interest.

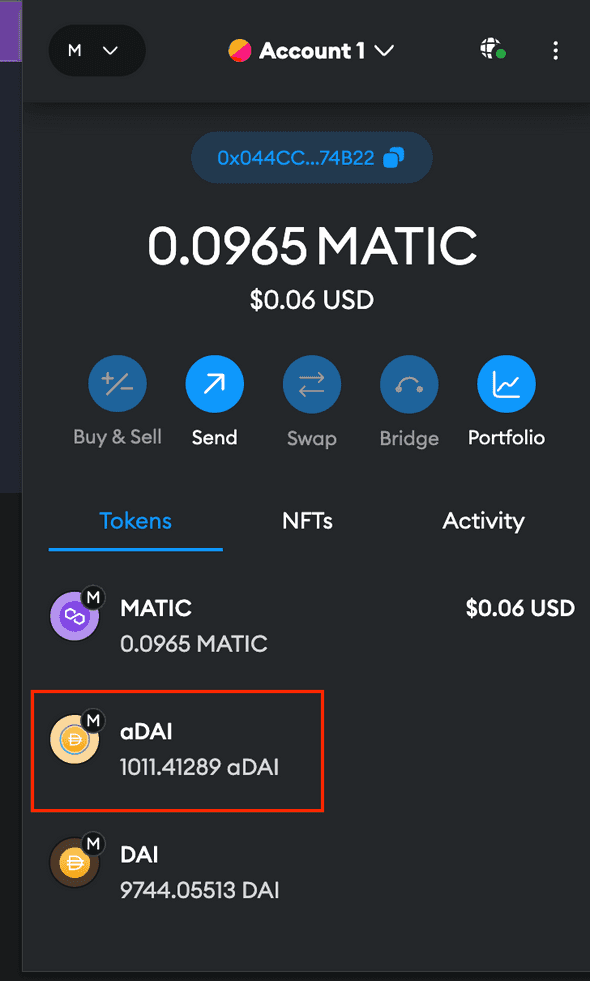

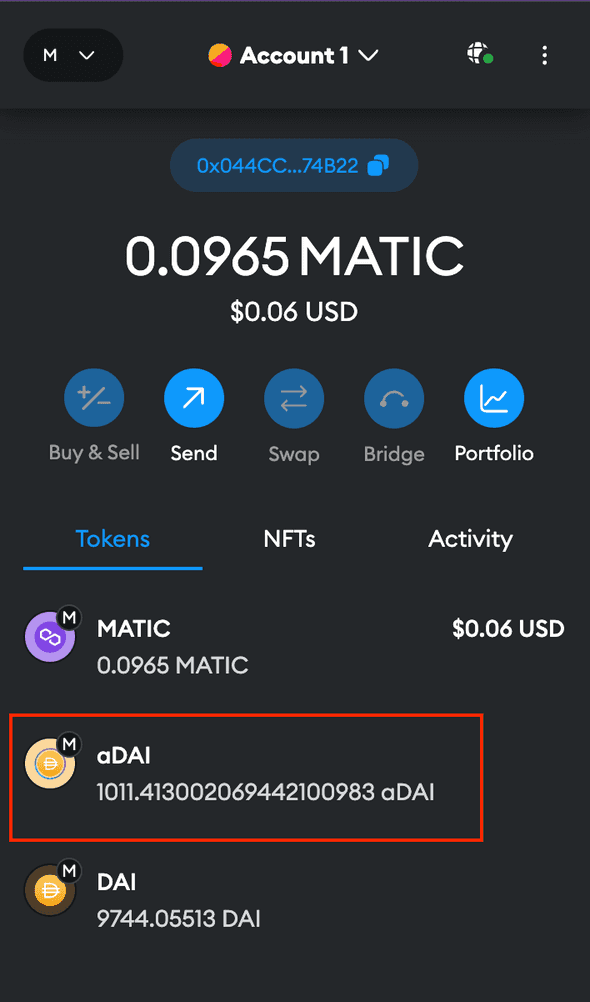

If you have tried any DeFi lending protocol before, you would retrieve some token that represents a token deposited in the protocol that is 1:1 to the real underlying asset in return to your deposit. For example, you get cToken on Compound, aToken on Aave, and zToken on Zklend. And if you check the balance of those tokens on metamask from time to time, you can notice that it changes over time, even if you don’t do anything. This is because of interest accrual.

Below is an example of aDai on Aave that increases over time as compound interest accrues:

But how is it done under the hood? Let’s read code on Zklend.

Below are functions to calculate the balance of a ZToken.

fn balanceOf(self: @ContractState, account: ContractAddress) -> u256 {

felt_balance_of(self, account).into()

}

fn felt_balance_of(self: @ContractState, account: ContractAddress) -> felt252 {

let accumulator = internal::get_accumulator(self);

let balance = self.raw_balances.read(account);

let scaled_up_balance = safe_decimal_math::mul(balance, accumulator);

scaled_up_balance

}felt_balance_of reads from ContractState the raw balance of the token, but it times that with accumulator. So that’s the secret. If the value of accumulator is somehow dynamic, every time your Metamask wallet calls balanceOf from the blockchain, the token balance should also be dynamic.

But what does accumulator do? First of all, get_accumulator will get the corresponding accumulator that is in the Market contract by calling get_lending_accumulator.

fn get_accumulator(self: @ContractState) -> felt252 {

let market_addr = self.market.read();

let underlying_addr = self.underlying.read();

IMarketDispatcher { contract_address: market_addr }.get_lending_accumulator(underlying_addr)

}This is get_lending_accumulator, where the compound interest is calculated:

fn get_lending_accumulator(self: @ContractState, token: ContractAddress) -> felt252 {

internal::assert_reserve_enabled(self, token);

let reserve = self.reserves.read_for_get_lending_accumulator(token);

let block_timestamp: felt252 = get_block_timestamp().into();

if reserve.last_update_timestamp == block_timestamp {

// Accumulator already updated on the same block

reserve.lending_accumulator

} else {

// Apply simple interest

let time_diff = safe_math::sub(block_timestamp, reserve.last_update_timestamp);

// Treats reserve factor as zero if treasury address is not set

let treasury_addr = self.treasury.read();

let effective_reserve_factor = if treasury_addr.is_zero() {

0

} else {

reserve.reserve_factor

};

let one_minus_reserve_factor = safe_math::sub(

safe_decimal_math::SCALE, effective_reserve_factor

);

// New accumulator

// (current_lending_rate * (1 - reserve_factor) * time_diff / SECONDS_PER_YEAR + 1) * accumulator

let temp_1 = safe_math::mul(reserve.current_lending_rate, time_diff);

let temp_2 = safe_math::mul(temp_1, one_minus_reserve_factor);

let temp_3 = safe_math::div(temp_2, SECONDS_PER_YEAR);

let temp_4 = safe_math::div(temp_3, safe_decimal_math::SCALE);

let temp_5 = safe_math::add(temp_4, safe_decimal_math::SCALE);

let latest_accumulator = safe_decimal_math::mul(temp_5, reserve.lending_accumulator);

latest_accumulator

}

}Below is the description of the variables being used from self.reserves:

| name | description |

|---|---|

last_update_timestamp |

the timestamp at which lending_accumulator was updated for the last time, in seconds since the epoch |

lending_accumulator |

cumulated liquidity index (or simply interest index). Tracks the interest cumulated by the reserve during the time interval, updated whenever a borrow, deposit, repay, redeem, swap, liquidation event occurs. |

current_lending_rate |

the current lending rate that was calculated by get_interest_rates of DefaultInterestRateModel |

The equation for calculating a cumulated liquidity/borrow index is as follows:

where

we can see that is represented by current_lending_rate * (1 - reserve_factor), and by time_diff / SECONDS_PER_YEAR (look at the comment in the code), and by reserve.lending_accumulator.

This works exactly the same way for get_debt_accumulator:

fn get_debt_accumulator(self: @ContractState, token: ContractAddress) -> felt252 {

internal::assert_reserve_enabled(self, token);

let reserve = self.reserves.read_for_get_debt_accumulator(token);

let block_timestamp: felt252 = get_block_timestamp().into();

if (reserve.last_update_timestamp == block_timestamp) {

// Accumulator already updated on the same block

reserve.debt_accumulator

} else {

// Apply simple interest

let time_diff = safe_math::sub(block_timestamp, reserve.last_update_timestamp);

// (current_borrowing_rate * time_diff / SECONDS_PER_YEAR + 1) * accumulator

let temp_1 = safe_math::mul(reserve.current_borrowing_rate, time_diff);

let temp_2 = safe_math::div(temp_1, SECONDS_PER_YEAR);

let temp_3 = safe_math::add(temp_2, safe_decimal_math::SCALE);

let latest_accumulator = safe_decimal_math::mul(temp_3, reserve.debt_accumulator);

latest_accumulator

}

}It is the same logic as get_lending_accumulator, except that the reserve factor is not a part of the equation because we are taking profit from the debtors, not for lending. That means we want to take the full borrow index as it is from the debt, and instead lower the liquidity index for lending so that the protocol can take certain % as a profit.

Example: interest rate calculation

To find the final amount of borrowing or deposit with the accrued interests considered, all you need to do is to multiply the raw principal value with the cumulated liquidity/borrow index. But calculating the index requires calculating interest rates. So let’s dive into one example. This example is based on zklend’s smart contract tests.

Here’s an example for calculating accrued interests for borrowing and deposit.

Let’s say we got $SIS and $BRO tokens:

| Token | Oracle Price (USD) | Collateral factor | Reserve factor | ||||

|---|---|---|---|---|---|---|---|

| $SIS | 50 | 50% | 0.1 | 0.5 | 1% | 60% | 10% |

| $BRO | 100 | 75% | 0.2 | 0.3 | 5% | 80% | 20% |

Bob deposits $BRO, Alice deposits $SIS.

Alice borrows

22.5 $BRO =

which is well within the value of collateral supplied.

Now,

Now we calculate the supply interest rate, but without considering the reserve factor for now.

So there we have it:

Example (continued): cumulated liquidity index & cumulated borrow index calculation

And let’s say:

- 100 seconds have elapsed, starting from timestamp 0

- no cumulated liquidity index and cumulated borrow index were calculated before, making them 1 respectively by default

Then you can calculate them as follows:

Instead of factoring the reserve factor into the lending rate, we instead do it when we calculate it in the cumulated liquidity index.

is calculated as 100 seconds divided by the number of seconds per year (without caring about leap years).

Other than this, the calculation above should be straightforward.

Update frequency of cumulated liquidity index and interest rates

The cumulated liquidity index is updated once per block only. You can go back and check this line:

if (reserve.last_update_timestamp == block_timestamp) {

// Accumulator already updated on the same block

reserve.debt_accumulator

}So even if further transactions take place in the same block, the accumulator will change only once for the first transaction in the block and that will be it.

However, interest rates will update every transaction that relates to the change in the amount of value borrowed/lent. This means that the accumulator will take the last available interest rate into consideration, which should be from more than or equal to one previous block from the current block.

This makes sense because accumulators use the time difference between the last update time and now. So it’s not possible to update accumulators more than once in the same block.

But the liquidity in the same block can change multiple times, which means there can be varying interest rates per block. The last interest rate of that block will be used for the next accumulator calculation in the later block.

Accumulator example:

- https://starkscan.co/event/0x0359993b4c7ceac20c64fdfb74a9096e0bde30fe8b7439b2382c63f4256405e1_1

- https://starkscan.co/event/0x052fd45de382dbd2b2f69d5d313135cf392ed9736b649aa03d2bf25d812afe39_0

Two different AccumulatorsSync events for the same token 0x49d36570d4e46f48e99674bd3fcc84644ddd6b96f7c741b1562b82f9e004dc7, but the value of accumulators stays the same.

Interest rates example:

- https://starkscan.co/event/0x061536cd135f4e51f861b693208cee8b1c47f8b0962fca5d90efe89b9f64d71a_2

- https://starkscan.co/event/0x052fd45de382dbd2b2f69d5d313135cf392ed9736b649aa03d2bf25d812afe39_2

Two different InterestRatesSync events, in the same block 10000, for the same asset 0x49d36570d4e46f48e99674bd3fcc84644ddd6b96f7c741b1562b82f9e004dc7 but different lending_rate and borrowing_rate.

Approximation of compound interest over a time period

It is impossible to predictably calculate the compound interest accrued/earned from the protocol because the interest rate is variable every block, and the movement of interest rates cannot be predicted without users’ actions.

There is a way to run an approximate calculation: continuous compounding interest formula.

where

To elaborate, let’s take an example: you deposit 25 USDC and wait for a month. The projected average APY over the month is 5%, so we just take a stable 5% APY for example.

Then,

This means the compound interest for an average of 5% APY over a month is approximately 0.10 zUSDC.

The reason we use continuous compounding is that the frequency of compounding is simply impossible to be predicted in the case of lending protocols on blockchain and the time difference between each compounding is always different. The frequency of compounding under a given time period is .

Let’s give an example of AccumulatorsSync event for token 0x68f5c6a61780768455de69077e07e89787839bf8166decfbf92b645209c0fb8 from block 61993 to 61998:

- at block 61993

- at block 61997

- at block 61998

| block | event | timestamp | time diff (secs) from previous compounding |

|---|---|---|---|

| 61993 | link | 1684912486 | - |

| 61997 | link | 1684912643 | 157 |

| 61998 | link | 1684912678 | 35 |

Given that there were already existing accumulators before block 61993, the lending and borrowing accumulators compounded 3 times within the specified block range.

And the time difference between each compounding event is different, making us unable to use the traditional compound interest formula (), where you need to specify , which is always variable as explained in above example. Also, each compounding period isn’t constant; so this equation can’t really be used, because it assumes that each compounding period is the same. Therefore, a fair approximation can be better deduced by using continuous compounding interest formula.

Liquidation

A few more terms need to be defined to be able to understand liquidation.

Health factor. . It denotes the status of user’s position. If the health factor is lower than 1, the position may be liquidated, because that would mean the value of collaterals is not enough to back the value of borrowings.

Liquidation bonus (or penalty, for debtors). Additional % applied on the collateral deposited by the debtor, which in turn is received by the liquidator after the repayment. This is to incentivize liquidators to liquidate.

Potential liquidators will be monitoring the market closely and frequently, and try to call liquidate() earlier than their competitors with suitable amount of gas fee that might get their transaction get through earlier than others. Once the transaction gets through, the debtor’s position will be liquidated and the corresponding amount of collateral in USD plus the liquidation bonus will be paid back to the liquidator. Liquidators are only allowed to repay no more than the amount that will bring the borrower’s Health Factor back to 1.

Liquidation is essential to the healthy operation of a lending protocol; it removes unhealthy, undercollateralized positions to keep it healthy.

Technical review

Deposit

All typical user interactions will be done at market.cairo file.

The deposit function in market.cairo will call deposit function from market/external.cairo:

// deposit in market.cairo

fn deposit(ref self: ContractState, token: ContractAddress, amount: felt252) {

external::deposit(ref self, token, amount)

}Again, that will call internal::deposit from market/internal.cairo.

// deposit in market/external.cairo

fn deposit(ref self: ContractState, token: ContractAddress, amount: felt252) {

reentrancy_guard::start(ref self);

internal::deposit(ref self, token, amount);

reentrancy_guard::end(ref self);

}// deposit in market/internal.cairo

fn deposit(ref self: ContractState, token: ContractAddress, amount: felt252) {

assert(amount.is_non_zero(), errors::ZERO_AMOUNT);

let caller = get_caller_address();

let this_address = get_contract_address();

let UpdatedAccumulators{debt_accumulator: updated_debt_accumulator, .. } = update_accumulators(

ref self, token

);

assert_reserve_enabled(@self, token);

let z_token_address = self.reserves.read_z_token_address(token);

// Updates interest rate

update_rates_and_raw_total_debt(

ref self,

token, // token

updated_debt_accumulator, // updated_debt_accumulator

false, // is_delta_reserve_balance_negative

amount, // abs_delta_reserve_balance

false, // is_delta_raw_total_debt_negative

0 // abs_delta_raw_total_debt

);

self

.emit(

contract::Event::Deposit(

contract::Deposit { user: caller, token: token, face_amount: amount }

)

);

// Takes token from user

let amount_u256: u256 = amount.into();

let transfer_success = IERC20Dispatcher {

contract_address: token,

}.transferFrom(caller, this_address, amount_u256);

assert(transfer_success, errors::TRANSFERFROM_FAILED);

// Mints ZToken to user

IZTokenDispatcher { contract_address: z_token_address }.mint(caller, amount);

}The first thing that this deposit function does is to call update_accumulators:

fn update_accumulators(ref self: ContractState, token: ContractAddress) -> UpdatedAccumulators {

let block_timestamp: felt252 = get_block_timestamp().into();

let updated_lending_accumulator = view::get_lending_accumulator(@self, token);

let updated_debt_accumulator = view::get_debt_accumulator(@self, token);

self

.emit(

contract::Event::AccumulatorsSync(

contract::AccumulatorsSync {

token,

lending_accumulator: updated_lending_accumulator,

debt_accumulator: updated_debt_accumulator

}

)

);

// It's okay to call this function here as the updated accumulators haven't been written into

// storage yet

let amount_to_treasury = view::get_pending_treasury_amount(@self, token);

// No need to check reserve existence since it's done in `get_lending_accumulator` and

// `get_debt_accumulator`

let z_token_address = self.reserves.read_z_token_address(token);

self

.reserves

.write_accumulators(

token, block_timestamp, updated_lending_accumulator, updated_debt_accumulator

);

// No need to check whether treasury address is zero as amount would be zero anyways

if amount_to_treasury.is_non_zero() {

let treasury_addr = self.treasury.read();

IZTokenDispatcher {

contract_address: z_token_address

}.mint(treasury_addr, amount_to_treasury);

}

UpdatedAccumulators {

lending_accumulator: updated_lending_accumulator, debt_accumulator: updated_debt_accumulator

}

}And this respectively calls accumulators for debt and lending:

fn get_lending_accumulator(self: @ContractState, token: ContractAddress) -> felt252 {

internal::assert_reserve_enabled(self, token);

let reserve = self.reserves.read_for_get_lending_accumulator(token);

let block_timestamp: felt252 = get_block_timestamp().into();

if reserve.last_update_timestamp == block_timestamp {

// Accumulator already updated on the same block

reserve.lending_accumulator

} else {

// Apply simple interest

let time_diff = safe_math::sub(block_timestamp, reserve.last_update_timestamp);

// Treats reserve factor as zero if treasury address is not set

let treasury_addr = self.treasury.read();

let effective_reserve_factor = if treasury_addr.is_zero() {

0

} else {

reserve.reserve_factor

};

let one_minus_reserve_factor = safe_math::sub(

safe_decimal_math::SCALE, effective_reserve_factor

);

// New accumulator

// (current_lending_rate * (1 - reserve_factor) * time_diff / SECONDS_PER_YEAR + 1) * accumulator

let temp_1 = safe_math::mul(reserve.current_lending_rate, time_diff);

let temp_2 = safe_math::mul(temp_1, one_minus_reserve_factor);

let temp_3 = safe_math::div(temp_2, SECONDS_PER_YEAR);

let temp_4 = safe_math::div(temp_3, safe_decimal_math::SCALE);

let temp_5 = safe_math::add(temp_4, safe_decimal_math::SCALE);

let latest_accumulator = safe_decimal_math::mul(temp_5, reserve.lending_accumulator);

latest_accumulator

}

}

fn get_debt_accumulator(self: @ContractState, token: ContractAddress) -> felt252 {

internal::assert_reserve_enabled(self, token);

let reserve = self.reserves.read_for_get_debt_accumulator(token);

let block_timestamp: felt252 = get_block_timestamp().into();

if (reserve.last_update_timestamp == block_timestamp) {

// Accumulator already updated on the same block

reserve.debt_accumulator

} else {

// Apply simple interest

let time_diff = safe_math::sub(block_timestamp, reserve.last_update_timestamp);

// (current_borrowing_rate * time_diff / SECONDS_PER_YEAR + 1) * accumulator

let temp_1 = safe_math::mul(reserve.current_borrowing_rate, time_diff);

let temp_2 = safe_math::div(temp_1, SECONDS_PER_YEAR);

let temp_3 = safe_math::add(temp_2, safe_decimal_math::SCALE);

let latest_accumulator = safe_decimal_math::mul(temp_3, reserve.debt_accumulator);

latest_accumulator

}

}We already discussed in depth what an accumulator is and why it needs to be used. They need to be updated every single time the corresponding interest rate needs to change.

After updating the accumulators, amount_to_treasury is calculated and that amount is sent to the treasury, in the form of zToken. Remember that zToken is redeemable at 1:1 rate with the underlying asset, so it’s the same as sending real token to the reasury.

Next in internal::deposit, update_rates_and_raw_total_debt is called. This function does two things as it name suggests; but it will only update the rate for deposit operation, as you can tell from the argument of 0 for abs_delta_raw_total_debt.

However if reserve.last_update_timestamp is not the current block timestamp, the debt accumulator would still get updated and will affect the interest rate calculated inside update_rates_and_raw_total_debt, because the ‘scaled’ debt (that is, principal value of debt multiplied by the latest debt accumulator) would be slightly larger than the one calculated at the previous block timestamp.

Here is update_rates_and_raw_total_debt:

fn update_rates_and_raw_total_debt(

ref self: ContractState,

token: ContractAddress,

updated_debt_accumulator: felt252,

is_delta_reserve_balance_negative: bool,

abs_delta_reserve_balance: felt252,

is_delta_raw_total_debt_negative: bool,

abs_delta_raw_total_debt: felt252,

) {

let this_address = get_contract_address();

let StorageBatch1{

interest_rate_model, raw_total_debt: raw_total_debt_before } = self

.reserves

.read_interest_rate_model_and_raw_total_debt(token);

// Makes sure reserve exists

// (the caller must check it's enabled if needed since it's not validated here)

assert(interest_rate_model.is_non_zero(), errors::RESERVE_NOT_FOUND);

let reserve_balance_before: felt252 = IERC20Dispatcher {

contract_address: token

}.balanceOf(this_address).try_into().expect(errors::BALANCE_OVERFLOW);

let reserve_balance_after = if is_delta_reserve_balance_negative {

safe_math::sub(reserve_balance_before, abs_delta_reserve_balance)

} else {

safe_math::add(reserve_balance_before, abs_delta_reserve_balance)

};

let raw_total_debt_after = if is_delta_raw_total_debt_negative {

safe_math::sub(raw_total_debt_before, abs_delta_raw_total_debt)

} else {

safe_math::add(raw_total_debt_before, abs_delta_raw_total_debt)

};

let scaled_up_total_debt_after = safe_decimal_math::mul(

raw_total_debt_after, updated_debt_accumulator

);

let ModelRates{lending_rate: new_lending_rate, borrowing_rate: new_borrowing_rate } =

IInterestRateModelDispatcher {

contract_address: interest_rate_model

}.get_interest_rates(reserve_balance_after, scaled_up_total_debt_after);

// Writes to storage

self.reserves.write_rates(token, new_lending_rate, new_borrowing_rate);

if raw_total_debt_before != raw_total_debt_after {

self.reserves.write_raw_total_debt(token, raw_total_debt_after);

}

self

.emit(

contract::Event::InterestRatesSync(

contract::InterestRatesSync {

token, lending_rate: new_lending_rate, borrowing_rate: new_borrowing_rate

}

)

);

}It reads existing interest_rate_model, raw_total_debt: raw_total_debt_before from the storage. And then runs calculations to get parameters for IInterestRateModelDispatcher.get_interest_rates.

After that, the newly calculated interest rates and debt are updated.

Finally, transferFrom of the underlying ERC20 token is called in internal::deposit function. This is where the actual transfer happens.

Lastly, the interest bearing zToken of the exact same deposit amount for that specific ERC20 token is minted back to the user, so they can track the sum of their principal and interest at any time.

Withdraw

Everything that is meant to be accessed on zklend frontend is defined in src/market/external.cairo, just like deposit. So is withdraw, and it again calls internal::withdraw.

withdraw in src/market/internal.cairo:

fn withdraw(ref self: ContractState, token: ContractAddress, amount: felt252) {

assert(amount.is_non_zero(), errors::ZERO_AMOUNT);

let caller = get_caller_address();

withdraw_internal(ref self, caller, token, amount);

}So the real meat must be in withdraw_internal.

withdraw_internal in src/market/internal.cairo:

fn withdraw_internal(

ref self: ContractState, user: ContractAddress, token: ContractAddress, amount: felt252

) {

let UpdatedAccumulators{debt_accumulator: updated_debt_accumulator, .. } = update_accumulators(

ref self, token

);

assert_reserve_enabled(@self, token);

let z_token_address = self.reserves.read_z_token_address(token);

// NOTE: it's fine to call out to external contract here before state update since it's trusted

let amount_burnt = burn_z_token_internal(ref self, z_token_address, user, amount);

// Updates interest rate

update_rates_and_raw_total_debt(

ref self,

token, // token

updated_debt_accumulator, // updated_debt_accumulator

true, // is_delta_reserve_balance_negative

amount_burnt, // abs_delta_reserve_balance

false, // is_delta_raw_total_debt_negative

0, // abs_delta_raw_total_debt

);

self

.emit(

contract::Event::Withdrawal(

contract::Withdrawal { user, token, face_amount: amount_burnt }

)

);

// Gives underlying tokens to user

let amount_burnt: u256 = amount_burnt.into();

let transfer_success = IERC20Dispatcher {

contract_address: token

}.transfer(user, amount_burnt);

assert(transfer_success, errors::TRANSFER_FAILED);

// It's easier to post-check collateralization factor, at the cost of making failed

// transactions more expensive.

let is_asset_used_as_collateral = is_used_as_collateral(@self, user, token);

// No need to check if the asset is not used as collateral at all

if is_asset_used_as_collateral {

assert_not_undercollateralized(@self, user, true);

}

}Basically, the exact opposite of internal::deposit.

The first bit is the same; It starts off by calling update_accumulators to get updated_debt_accumulator which will be used as an argument to update_rates_and_raw_total_debt:

let UpdatedAccumulators{debt_accumulator: updated_debt_accumulator, .. } = update_accumulators(

ref self, token

);Then, the corresponding amount of zToken is burnt:

let z_token_address = self.reserves.read_z_token_address(token);

// NOTE: it's fine to call out to external contract here before state update since it's trusted

let amount_burnt = burn_z_token_internal(ref self, z_token_address, user, amount);If amount is not zero, zToken’s external::burn will be called:

fn burn(ref self: ContractState, user: ContractAddress, amount: felt252) {

internal::only_market(@self);

let accumulator = internal::get_accumulator(@self);

let scaled_down_amount = safe_decimal_math::div(amount, accumulator);

assert(scaled_down_amount.is_non_zero(), errors::INVALID_BURN_AMOUNT);

let raw_balance_before = self.raw_balances.read(user);

let raw_balance_after = safe_math::sub(raw_balance_before, scaled_down_amount);

self.raw_balances.write(user, raw_balance_after);

let raw_supply_before = self.raw_total_supply.read();

let raw_supply_after = safe_math::sub(raw_supply_before, scaled_down_amount);

self.raw_total_supply.write(raw_supply_after);

let amount: u256 = amount.into();

self

.emit(

contract::Event::Transfer(

contract::Transfer { from: user, to: contract_address_const::<0>(), value: amount }

)

);

}let accumulator = internal::get_accumulator(@self); gets the current lending accumulator so it can be used for further calculations. Remember, zToken has a dynamic balance due to the accumulator.

So why let scaled_down_amount = safe_decimal_math::div(amount, accumulator);? The reason is that the amount that the user requests to withdraw, passed down as amount: felt252 argument, already assumes that the amount has the interest index (the accumulator) factored in.

Let’s go back to the example presented before.

If you see aDAI (just imagine it’s a zToken, it’s the same thing essentially anyways) balance of and let’s say you want to withdraw everything that you have.

Then you know that the amount that you are looking at on MetaMask is the principal amount multiplied by the lending accumulator.

However, in fn burn, we want to subtract the amount from the principal (denoted as raw_* in the code) which does not have the accumulator factored in; it is literally the exact amount that the user had deposited before. To be able to do that, we need to convert amount into the same scale. This is because we only store the principal value on the blockchain instead of the principal multiplied by the accumulator.

Now we understand why it has to be:

let raw_balance_after = safe_math::sub(raw_balance_before, scaled_down_amount);and

let raw_supply_after = safe_math::sub(raw_supply_before, scaled_down_amount);Lastly, Transfer event where the token is sent to the null address is emitted, and burn function exits.

Next up is update_rates_and_raw_total_debt:

update_rates_and_raw_total_debt(

ref self,

token, // token

updated_debt_accumulator, // updated_debt_accumulator

true, // is_delta_reserve_balance_negative

amount_burnt, // abs_delta_reserve_balance

false, // is_delta_raw_total_debt_negative

0, // abs_delta_raw_total_debt

);Similar to deposit function, we are running this because we know that the supply of a token has changed, and this must affect the position on the interest rate curve as per the earlier discussion. Notice true, // is_delta_reserve_balance_negative because we know that the reserve balance (the supply of the token being withdrawn) has decreased.

Calling update_rates_and_raw_total_debt will update borrowing and lending interest rates.

Then, the corresponding amount of ERC20 token is transferred to the user. Remember amount_burnt of zToken must be sent because a pair of zToken and ERC20 should be 1:1 in terms of their amounts.

// Gives underlying tokens to user

let amount_burnt: u256 = amount_burnt.into();

let transfer_success = IERC20Dispatcher {

contract_address: token

}.transfer(user, amount_burnt);After that, collateralization checks are done. If the user withdraws too much that his borrowing is undercollateralized, the transaction would fail.

// It's easier to post-check collateralization factor, at the cost of making failed

// transactions more expensive.

let is_asset_used_as_collateral = is_used_as_collateral(@self, user, token);

// No need to check if the asset is not used as collateral at all

if is_asset_used_as_collateral {

assert_not_undercollateralized(@self, user, true);

}It’s easier to check collateralization after all calculations regarding everything else are finished, because that way all variables such as the amount of token after withdrawal are already available for use. We will look at collateralization checks in more details in later sections.

Borrow

At this point, we know how src/market/external.cairo and src/market/internal.cairo work, so we will go straight into internal::borrow:

fn borrow(ref self: ContractState, token: ContractAddress, amount: felt252) {

let caller = get_caller_address();

let UpdatedAccumulators{debt_accumulator: updated_debt_accumulator, .. } = update_accumulators(

ref self, token

);

assert_reserve_enabled(@self, token);

let scaled_down_amount = safe_decimal_math::div(amount, updated_debt_accumulator);

assert(scaled_down_amount.is_non_zero(), errors::INVALID_AMOUNT);

// Updates user debt data

let raw_user_debt_before = self.raw_user_debts.read((caller, token));

let raw_user_debt_after = safe_math::add(raw_user_debt_before, scaled_down_amount);

self.raw_user_debts.write((caller, token), raw_user_debt_after);

set_user_has_debt(ref self, caller, token, raw_user_debt_before, raw_user_debt_after);

// Updates interest rate

update_rates_and_raw_total_debt(

ref self,

token, // token

updated_debt_accumulator, // updated_debt_accumulator

true, // is_delta_reserve_balance_negative

amount, // abs_delta_reserve_balance

false, // is_delta_raw_total_debt_negative

scaled_down_amount // abs_delta_raw_total_debt

);

// Enforces token debt limit

assert_debt_limit_satisfied(@self, token);

self

.emit(

contract::Event::Borrowing(

contract::Borrowing {

user: caller, token: token, raw_amount: scaled_down_amount, face_amount: amount

}

)

);

// It's easier to post-check collateralization factor

assert_not_undercollateralized(@self, caller, true);

let amount_u256: u256 = amount.into();

let transfer_success = IERC20Dispatcher {

contract_address: token

}.transfer(caller, amount_u256);

assert(transfer_success, errors::TRANSFER_FAILED);

}First, we get the latest debt accumulator by running update_accumulators.

Then again we need to ‘scale down’ the amount argument at let scaled_down_amount = safe_decimal_math::div(amount, updated_debt_accumulator), because the amount that the user is requesting already has the borrowing accumulator factored in.

The scaled down amount can now be used to subtract from or add to the principal of the user’s debt:

// Updates user debt data

let raw_user_debt_before = self.raw_user_debts.read((caller, token));

let raw_user_debt_after = safe_math::add(raw_user_debt_before, scaled_down_amount);

self.raw_user_debts.write((caller, token), raw_user_debt_after);

set_user_has_debt(ref self, caller, token, raw_user_debt_before, raw_user_debt_after);Now we update the interest rate again by calling update_rates_and_raw_total_debt:

// Updates interest rate

update_rates_and_raw_total_debt(

ref self,

token, // token

updated_debt_accumulator, // updated_debt_accumulator

true, // is_delta_reserve_balance_negative

amount, // abs_delta_reserve_balance

false, // is_delta_raw_total_debt_negative

scaled_down_amount // abs_delta_raw_total_debt

);Notice the difference in the parameters passed in compared to deposit or withdraw:

true, // is_delta_reserve_balance_negative because the contract is borrowing a portion of the reserve to the user;

amount, // abs_delta_reserve_balance because amount is the actual amount that the user will receive as a result of borrowing;

false, // is_delta_raw_total_debt_negative because the total debt increases as a result of borrowing;

scaled_down_amount // abs_delta_raw_total_debt because the absolute amount of the difference in total debt that does not consider the borrowing interest index is scaled_down_amount.

Then, the debt limit is checked:

// Enforces token debt limit

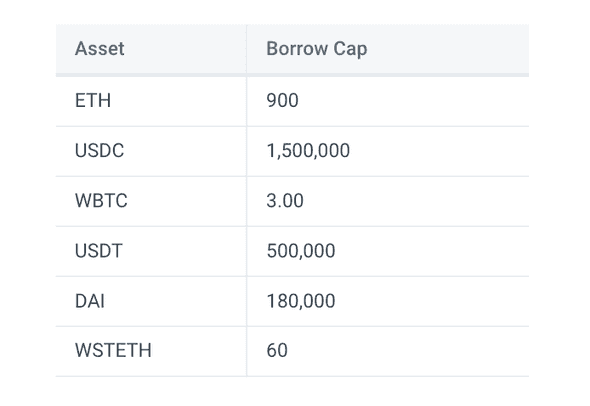

assert_debt_limit_satisfied(@self, token);On zklend documentation, this is described as a “borrow cap”. The debt limit is not per individual user; It is imposed at the individual liquidity pool level:

When the amount of total borrowing per token reaches the limit specified by the protocol, users won’t be able to borrow anymore until someone repays his debt.

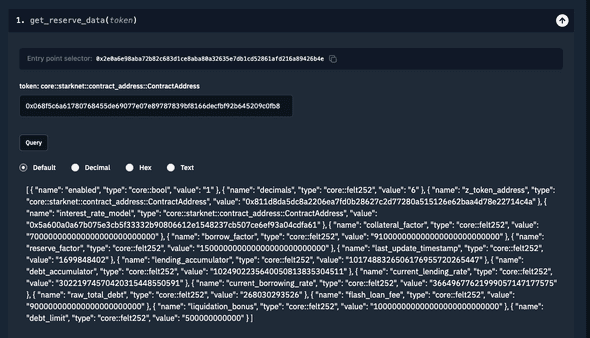

The debt limit can be checked at https://starkscan.co/contract/0x04c0a5193d58f74fbace4b74dcf65481e734ed1714121bdc571da345540efa05#read-write-contract. For example, for USDT of contract address 0x068f5c6a61780768455de69077e07e89787839bf8166decfbf92b645209c0fb8:

The debt limit is 500000000000. Because it has 6 decimal places, the actual debt limit is , which is in line with zklend’s documentation.

Then, the collateralization is checked by assert_not_undercollateralized(@self, caller, true) because users shouldn’t be able to borrow if they are not backed by enough collaterals.

There is a new term that we need to know about regarding assert_not_undercollateralized: borrow factor. It is a variable used to deduce the risk-adjusted value of a liability of a certain asset. For example, on zklend, the following is true:

| asset | collateral factor | borrow factor |

|---|---|---|

| ETH | 80% | 100% |

| USDT | 70% | 91% |

Let’s say you have deposited $1000 worth of ETH and want to borrow USDT. That means you can borrow dollars worth of USDT at max only. Essentially, borrow factor works to adjust the risk of the asset that is being borrowed, just like how collateral factor is used to adjust that of the asset being collateralized. So assert_not_undercollateralized takes this into account too.

Finally, after all checks are done, the requested amount is transferred to the user:

let amount_u256: u256 = amount.into();

let transfer_success = IERC20Dispatcher {

contract_address: token

}.transfer(caller, amount_u256);

assert(transfer_success, errors::TRANSFER_FAILED);Repay

Repayment takes three kinds: fn repay, fn repay_for, and fn repay_all. All is the same, except that repay_for is used to repay for someone else’s debt, and repay_all is used to repay for all debt owed.

So let’s look at repay:

fn repay(ref self: ContractState, token: ContractAddress, amount: felt252) {

assert(amount.is_non_zero(), errors::ZERO_AMOUNT);

let caller = get_caller_address();

let DebtRepaid{raw_amount, face_amount } = repay_debt_route_internal(

ref self, caller, caller, token, amount

);

self

.emit(

contract::Event::Repayment(

contract::Repayment {

repayer: caller, beneficiary: caller, token, raw_amount, face_amount

}

)

);

}All business is done at repay_debt_route_internal:

/// `amount` with `0` means repaying all. Returns actual debt amounts repaid.

fn repay_debt_route_internal(

ref self: ContractState,

repayer: ContractAddress,

beneficiary: ContractAddress,

token: ContractAddress,

amount: felt252

) -> DebtRepaid {

assert_reserve_enabled(@self, token);

let updated_debt_accumulator = view::get_debt_accumulator(@self, token);

if amount.is_zero() {

let user_raw_debt = self.raw_user_debts.read((beneficiary, token));

assert(user_raw_debt.is_non_zero(), errors::NO_DEBT_TO_REPAY);

let repay_amount = safe_decimal_math::mul(user_raw_debt, updated_debt_accumulator);

repay_debt_internal(ref self, repayer, beneficiary, token, repay_amount, user_raw_debt);

DebtRepaid { raw_amount: user_raw_debt, face_amount: repay_amount }

} else {

let raw_amount = safe_decimal_math::div(amount, updated_debt_accumulator);

assert(raw_amount.is_non_zero(), errors::INVALID_AMOUNT);

repay_debt_internal(ref self, repayer, beneficiary, token, amount, raw_amount);

DebtRepaid { raw_amount, face_amount: amount }

}

}This function is just a step before calling repay_debt_internal, and is designed to be called in all of the three repayment functions, and the code is pretty straightforward, given what we have been discussing so far.

So let’s look at repay_debt_internal:

/// ASSUMPTION: `repay_amount` = `raw_amount` * Debt Accumulator.

/// ASSUMPTION: it's always called by `repay_debt_route_internal`.

/// ASSUMPTION: raw_amount is non zero.

fn repay_debt_internal(

ref self: ContractState,

repayer: ContractAddress,

beneficiary: ContractAddress,

token: ContractAddress,

repay_amount: felt252,

raw_amount: felt252

) {

let this_address = get_contract_address();

let UpdatedAccumulators{debt_accumulator: updated_debt_accumulator, .. } = update_accumulators(

ref self, token

);

// No need to check if user is overpaying, as `safe_math::sub` below will fail anyways

// No need to check collateral value. Always allow repaying even if it's undercollateralized

// Updates user debt data

let raw_user_debt_before = self.raw_user_debts.read((beneficiary, token));

let raw_user_debt_after = safe_math::sub(raw_user_debt_before, raw_amount);

self.raw_user_debts.write((beneficiary, token), raw_user_debt_after);

set_user_has_debt(ref self, beneficiary, token, raw_user_debt_before, raw_user_debt_after);

// Updates interest rate

update_rates_and_raw_total_debt(

ref self,

token, // token

updated_debt_accumulator, // updated_debt_accumulator

false, // is_delta_reserve_balance_negative

repay_amount, // abs_delta_reserve_balance

true, // is_delta_raw_total_debt_negative

raw_amount // abs_delta_raw_total_debt

);

// Takes token from user

let repay_amount: u256 = repay_amount.into();

let transfer_success = IERC20Dispatcher {

contract_address: token

}.transferFrom(repayer, this_address, repay_amount);

assert(transfer_success, errors::TRANSFER_FAILED);

}Liquidate

fn liquidate(

ref self: ContractState,

user: ContractAddress,

debt_token: ContractAddress,

amount: felt252,

collateral_token: ContractAddress

) {

let caller = get_caller_address();

// Validates input

assert(amount.is_non_zero(), errors::ZERO_AMOUNT);

assert_reserve_enabled(@self, debt_token);

assert_reserve_enabled(@self, collateral_token);

let debt_reserve_decimals = self.reserves.read_decimals(debt_token);

let collateral_reserve = self.reserves.read(collateral_token);

// Liquidator repays debt for user

let DebtRepaid{raw_amount, .. } = repay_debt_route_internal(

ref self, caller, user, debt_token, amount

);

// Can only take from assets being used as collateral

let is_collateral = is_used_as_collateral(@self, user, collateral_token);

assert(is_collateral, errors::NONCOLLATERAL_TOKEN);

// Liquidator withdraws collateral from user

let oracle_addr = self.oracle.read();

let debt_token_price = IPriceOracleDispatcher {

contract_address: oracle_addr

}.get_price(debt_token);

let collateral_token_price = IPriceOracleDispatcher {

contract_address: oracle_addr

}.get_price(collateral_token);

let debt_value_repaid = safe_decimal_math::mul_decimals(

debt_token_price, amount, debt_reserve_decimals

);

let equivalent_collateral_amount = safe_decimal_math::div_decimals(

debt_value_repaid, collateral_token_price, collateral_reserve.decimals

);

let one_plus_liquidation_bonus = safe_math::add(

safe_decimal_math::SCALE, collateral_reserve.liquidation_bonus

);

let collateral_amount_after_bonus = safe_decimal_math::mul(

equivalent_collateral_amount, one_plus_liquidation_bonus

);

IZTokenDispatcher {

contract_address: collateral_reserve.z_token_address

}.move(user, caller, collateral_amount_after_bonus);

// Checks user collateralization factor after liquidation

assert_not_overcollateralized(@self, user, false);

self

.emit(

contract::Event::Liquidation(

contract::Liquidation {

liquidator: caller,

user,

debt_token,

debt_raw_amount: raw_amount,

debt_face_amount: amount,

collateral_token,

collateral_amount: collateral_amount_after_bonus,

}

)

);

}This is a publicly visible function that can be called directly by any liquidators.

The first step is the same as the repay function; The liquidator will repay for the undercollateralized asset for the debtor.

The next step is to take the collateral away from the debtor as a liquidator.

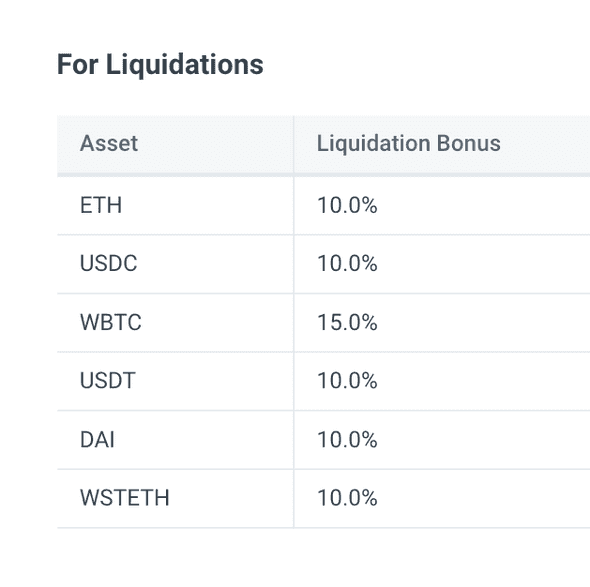

The amount that the liquidator is able to take away from the debtor is always , where varies from an asset to asset, and is decided by the protocol.

Currently, zklend’s liquidation bonus ranges from 10% to 15%:

After calculating the amount of collateral to be transferred to the liquidator, the function simply moves the zToken of the corresponding collateral from the debtor to the liquidator:

IZTokenDispatcher {

contract_address: collateral_reserve.z_token_address

}.move(user, caller, collateral_amount_after_bonus);Lastly, since zklend only allows the liquidator to recover the debtor’s position back to the health factor of 1 at maximum, it checks if the debtor is overcollateralized:

assert_not_overcollateralized(@self, user, false);Here’s an example of liquidation that works, adopted from zklend’s test case.

The setup is the same as the example used in the interest rate calculation:

| Token | Oracle Price (USD) | Collateral factor | Reserve factor | Liquidation bonus | ||||

|---|---|---|---|---|---|---|---|---|

| $SIS | 50 | 50% | 0.1 | 0.5 | 1% | 60% | 10% | 20% |

| $BRO | 100 | 75% | 0.2 | 0.3 | 5% | 80% | 20% | 10% |

Bob deposits $BRO, Alice deposits $SIS.

Alice borrows

22.5 $BRO =

So initially Alice is in a healthy position, because her health factor would be

Now, let’s suppose the price of $SIS declines to $40. Then Alice’s health factor will be:

This means of Alice’s liabilities = $250 worth of $BRO is now undercollateralized and can be readily liquidated by anyone.

While monitoring the market, Bob notices Alice is in an undercollateralized position, so he calls liquidate() function, repaying 6.25 $BRO for Alice instead.

Bob expects to receive:

… 18.75 $SIS, which is worth dollars. He spent dollars to repay, so as long as the gas fee is low enough, he’s made a profit of dollars.

After liquidation, Alice’s health factor is:

which means Alice is not overcollateralized, which if it was the case make the transaction rejected.

Liquidation should only work for undercollateralized positions. Liquidators cannot liquidate healthy positions.

Storage

WIP

Precision

WIP