What price will Bitcoin hit in April?

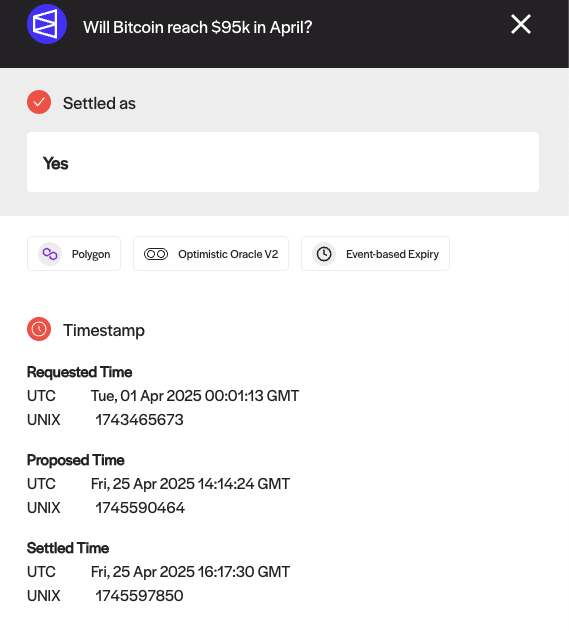

Came across this monthly bet on Polymarket. Specifically, I was looking at the bet on 95K, which resolved to be true on Apr 25.

And here's the resolution (wait longer for more data including 'proposed time' and 'settled time' to appear on the site):

And here're are the terms of the market:

This market will immediately resolve to "Yes" if any Binance 1 minute candle for Bitcoin (BTCUSDT) between April 1, 2025, 00:00 and April 30, 2025, 23:59 in the ET timezone has a final "High" price of $95,000 or higher. Otherwise, this market will resolve to "No."

The resolution source for this market is Binance, specifically the BTCUSDT "High" prices available at https://www.binance.com/en/trade/BTC_USDT, with the chart settings on "1m" for one-minute candles selected on the top bar.

Please note that the outcome of this market depends solely on the price data from the Binance BTCUSDT trading pair. Prices from other exchanges, different trading pairs, or spot markets will not be considered for the resolution of this market.

Then, immediately it got me thinking: will there be a room for me to still earn money before the market reached YES for 100%? What if the market is slow to reach 100% even after Binance's 1m High price hit 95K? If it's 97% YES, there's still a room for me to get 3% or less depending on the order book depth.

To do this, we need two things:

- Historical price data from Polymarket

- Historical price data from Binance

Binance

The candlestick we want to find is this one:

Exactly on 14:12 UTC, Apr 25, 2025, the condition for the resolution was fulfilled, with the candle's high and closing price going over 95K.

To confirm the data, we fetch historical data from Binance (we need to pay attention to "utc_time" and "high" column because that's all that matters):

So it turns out the first high price in April 2025 for BTCUSDT was precisely between 4/25/2025, 14:12:18 and 4/25/2025, 14:12:19:

Polymarket

Let's review the order book and close price close to 14:12 UTC, Apr 25, 2025 on that specific polymarket.

Prices close to 14:12 UTC, Apr 25, 2025

So actually at 4/25/2025, 14:12:05 UTC (t=1745590325), the price is still at 94.95%. But it's unclear how fast this price changed close to 99.95% to till that candle closed, as the smallest resolution we have is 1 minute:

In order to know this, we need to look at the order book data around this time on Polymarket. All we care about right now is what happened between 4/25/2025, 14:12:05 UTC and 4/25/2025, 14:13:05 UTC. Now it's just a matter of how long or short it took for the market to react to the price going over 95K at 4/25/2025, 14:12:18 on Binance.

Polymarket does not offer an endpoint hosted on its CLOB API specialized for historical order book data. Also it maintains its centralized orderbook, so there isn't much info we can get from Polymarket's subgraphs hosted on Goldky.

Instead we fetch from https://data-api.polymarket.com/trades?${queryParams.toString()} which is an undocumented API but is used by Polymarket's FE. It gives trades that happened for a specific market, sorted by timestamp (latest first).

Surprisingly, no one actually executed any trades until 4/25/2025, 14:12:34, which is about 15 seconds after the high in the 1s candle hit with 95K on Binance. Due to the absence of historical order books, we don't know how much profit/spread was available there for the first person who bought YES orders at the price of 94.9%.

If there was a sufficient liquidity (which we can't confirm), this is 25 USD profit for 500 USD on BUY YES, purely risk-free. After the price of 94.9%, the price still stayed at 99.8% for several orders at the same timestamp, still leaving a little room of profit for latecomers.

Another interesting discovery is that some people sold their YES positions before the market fully resolved, making some of the profits available for other traders again. Also, some stupid people bought NO even after Binance had shown its 1s candle going over 95K.

This opens up a ground for more research on similar markets. Polymarket has daily, weekly, monthly, or even yearly crypto markets such as Bitcoin Price - May 29, 5PM ET, Bitcoin up or Down on May 29?, What price will Bitcoin hit in 2025?.

The critical time in other markets

Now, let's call the period between the time at which the market resolution condition is reached and the the time at which first trade that happens in favor of that resolution in the market after that the critical time.

Let's review the critical time for these markets for last one month:

- Bitcoin Up or Down on [day of the month]?

- Ethereum Up or Down on [day of the month]?

- Solana Up or Down on [day of the month]?

- XRP Up or Down on [day of the month]?

These markets tend to have high volumes of tens of thousands or hundreds of thousands of USD, so it makes sense to do research on these.

The rules of the market allows follow this format:

This market will resolve to "Up" if the "Close" price for the Binance 1 minute candle for BTCUSDT 28 May '25 12:00 in the ET timezone (noon) is lower than the final "Close" price for the 29 May '25 12:00 ET candle.

This market will resolve to "Down" if the "Close" price for the Binance 1 minute candle for BTCUSDT 28 May '25 12:00 in the ET timezone (noon) is higher than the final "Close" price for the 29 May '25 12:00 ET candle.

- If the final "Close" price for both of these candles is exactly equal on Binance, this market will resolve 50-50

The resolution source for this market is Binance, specifically the BTCUSDT "Close" prices currently available at https://www.binance.com/en/trade/BTC_USDT with "1m" and "Candles" selected on the top bar.

Please note that this market is about the price according to Binance BTCUSDT, not according to other sources or spot markets.

So for this one, we actually don't need to refer to the market data as long as we already know the outcome. Just need to query the price and trades history.

Bitcoin daily bet price close to market close

It becomes pretty obvious that the volatility of Bitcoin price plays a big role on the bet price close to market close time, and the trend is extremely well priced-in. It seemse that for the days on which Bitcoin had a volatile trend around the target price, the graph would fluctuate a lot, and it wouldn't when it had a steady trend. It's probably because Bitcoin price is so readily accessible - there is almost no barriers to getting this information. So it'd be probably difficult to make money off of 'news trading' on this market.

Relevant discussions

This leads us to our next question, which is how fast does the price on Polymarket react to qualitative news that needs to be digested to be understood (e.g., GTA VI released in 2025)?

This research is an ongoing initiative run by Joel. Join the community for more: